22 – January 22

“Just about the time you think you can make both ends meet, somebody moves the ends.”—Pansy Penner

Irregular expenses are often budget-busters. This is because they aren’t a part of our regular, monthly expenses, and we tend to forget them. Then suddenly, like a harbinger of doom, there they are looming over your checkbook, cackling with glee that they’ve given you this nasty surprise. Your car breaks down and the repair bill is five hundred dollars. The water heater goes out, or the computer suddenly develops amnesia. The once-a-year insurance premium is due and you had forgotten all about it. It’s time for your yearly vacation, but you didn’t put money aside to take that cruise you want.

The solution is to make a list of all your irregular expenses by month. What is due in January that isn’t due any other month? Insurance premiums, taxes, vacation expenses, and club membership dues are not regular monthly expenses and should go on this list. Don’t forget to include money for repairs and maintenance on your automobiles, computer upgrades, Christmas presents, etc. Make a list for each month of the year, then total the amount of money for the entire year. Divide this number by twelve and you will have the average amount of money you spend on irregular expenses. Put this figure as a line item on your budget…

Now open an interest-bearing savings or money market account and deposit this amount into it every month. Then when bills come due that are on your irregular expense list, you pay it from your savings account. No more anxiety over forgotten expenses—the money is there! You now have knowledge and control over all your spending.

If you are in business and have seasonal income swings, you can use this account to deposit some of the money from your higher income months so that you can withdraw it to help with expenses during lower income months. A woman I consulted with had a tutoring business with a healthy income during the months that school was in session. But during the summer months when school was out, her income plummeted. I suggested she use an irregular expense account, which she started immediately. She divided her yearly income by twelve and made a budget to live within that income. The additional income she earned during her regular working season, she deposited into her irregular expense savings account. By the time summer came around, she had plenty of money saved to live on for the summer.

Now the side benefit kicked in. She like having savings and didn’t want to spend it. So she got into her creative mode and started inventing new ways to make money during the summer months. She developed a summer school curriculum and then started enrolling students. She made enough additional money that she didn’t need to take money out of her savings—and went on vacation for a month as well!

Today’s Affirmation:

“I have positive cash flow right here, right now, and always!”

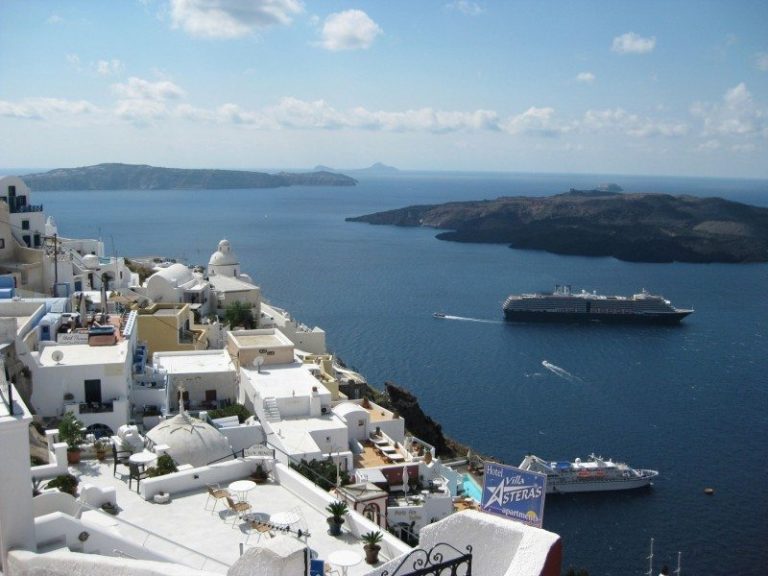

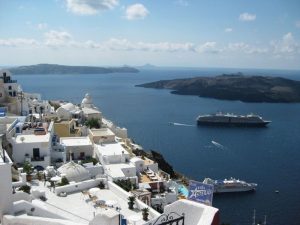

A few years ago, I ran into a big snag in booking my January Las Vegas getaway with my poker gal pals. For years, I had received promotions from the Venetian Hotel in Las Vegas for 3-4 nights free, plus $50-100 dining credits, plus $250-400 in free slot play. A gold card member, I really loved my deals! But when I called to make a reservation, my casino host told me that there were no promotions and he’d have to see what came through later. The best he could do was one night at $179 and two nights free. No dining credit. No free slot play.

Ouch! I checked with the Harrah’s chain to see if they were any different, and found the same pull-back in discounts. My offer package in November showed free rooms for all the hotels available all week, except for Caesar’s Palace which had discounted rates from $47-127 most nights. But the latest update I received showed no free rooms for Caesars, Planet Hollywood, or Paris, and only a few free nights for their other hotels (the Rio, Bally’s, Flamingo, Harrah’s, and Imperial Palace).

So we stayed at the Venetian and had a fabulous time, even though it cost a bit more than usual.

My guess is the pull-back in coupons and comps didn’t work. It was only about 6 months into 2011 when I started receiving all kinds of free offers for rooms and dinners and bonuses again. My guess would be that everyone rushed back to enjoy their perks! I’ll bet the casino’s income went up as a result of that…

Lesson? Sometimes if you give too much you get taken for granted, so perhaps it’s a good idea to withhold for a bit and make people realize what a great deal they were getting. Like sometimes don’t show up to your usual networking group and give them an opportunity to miss you. Then you’ll really be appreciated when you come back.